Does South Carolina Have Property Taxes . south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. this guide breaks down everything you need to know about south carolina property taxes. The average effective property tax rate in south carolina is 0.57%, but this. (1) the property value, (2) the assessment ratio applicable to the. the amount of property tax due is based upon three elements: property taxes in south carolina. Find the resources you need to figure out what your. Real and personal property are. property tax is administered and collected by local governments, with assistance from the scdor. Part of the reason taxes are so.

from www.signnow.com

this guide breaks down everything you need to know about south carolina property taxes. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. Real and personal property are. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. (1) the property value, (2) the assessment ratio applicable to the. the amount of property tax due is based upon three elements: The average effective property tax rate in south carolina is 0.57%, but this. property tax is administered and collected by local governments, with assistance from the scdor. Part of the reason taxes are so. property taxes in south carolina.

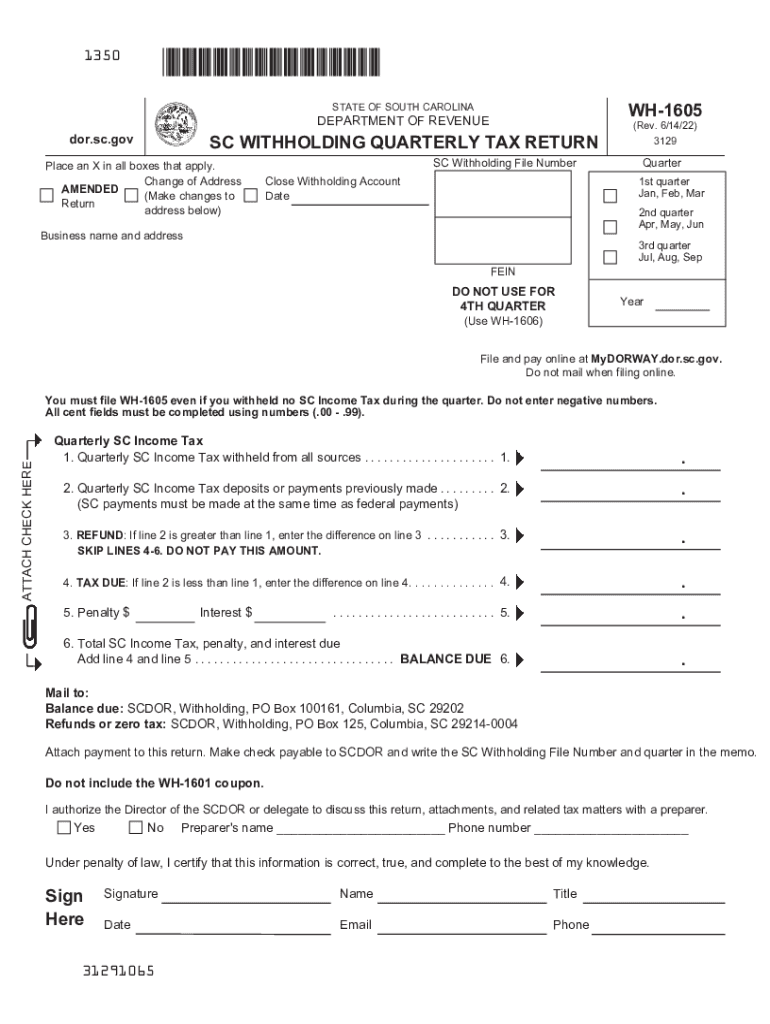

Wh 1605 20222024 Form Fill Out and Sign Printable PDF Template

Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Part of the reason taxes are so. the amount of property tax due is based upon three elements: property taxes in south carolina. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. (1) the property value, (2) the assessment ratio applicable to the. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. Find the resources you need to figure out what your. south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Real and personal property are. this guide breaks down everything you need to know about south carolina property taxes. property tax is administered and collected by local governments, with assistance from the scdor. The average effective property tax rate in south carolina is 0.57%, but this.

From www.signnow.com

SOUTH CAROLINA Individual Tax Fill Out and Sign Printable PDF Does South Carolina Have Property Taxes property tax is administered and collected by local governments, with assistance from the scdor. Find the resources you need to figure out what your. property taxes in south carolina. (1) the property value, (2) the assessment ratio applicable to the. the amount of property tax due is based upon three elements: this guide breaks down everything. Does South Carolina Have Property Taxes.

From www.youtube.com

South Carolina State Taxes Explained Your Comprehensive Guide YouTube Does South Carolina Have Property Taxes property taxes in south carolina. Real and personal property are. The average effective property tax rate in south carolina is 0.57%, but this. (1) the property value, (2) the assessment ratio applicable to the. the amount of property tax due is based upon three elements: the state reimburses local jurisdictions to help offset the reduction in property. Does South Carolina Have Property Taxes.

From www.ezhomesearch.com

Ultimate Guide to Understanding South Carolina Property Taxes Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. The average effective property tax rate in south carolina is 0.57%, but this. Real and personal property are. (1) the. Does South Carolina Have Property Taxes.

From imagetou.com

Tax Percentage In South Africa 2024 Image to u Does South Carolina Have Property Taxes property tax is administered and collected by local governments, with assistance from the scdor. The average effective property tax rate in south carolina is 0.57%, but this. south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Real and personal property are. the state reimburses local jurisdictions to. Does South Carolina Have Property Taxes.

From www.youtube.com

Property Taxes in South Carolina YouTube Does South Carolina Have Property Taxes property tax is administered and collected by local governments, with assistance from the scdor. south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. the amount of property tax due is based upon three elements: Find the resources you need to figure out what your. property taxes. Does South Carolina Have Property Taxes.

From www.taxuni.com

South Carolina State Tax 2023 2024 Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. The average effective property tax rate in south carolina is 0.57%, but this. Find the resources you need to figure out what your. (1) the property value, (2) the assessment ratio applicable to the. Real and personal property are. . Does South Carolina Have Property Taxes.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities Does South Carolina Have Property Taxes Real and personal property are. south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. (1) the property value, (2) the assessment ratio applicable to the. Part of the reason. Does South Carolina Have Property Taxes.

From parkerlawsc.com

Understanding Probate Taxes In South Carolina Parker Law, LLC Does South Carolina Have Property Taxes Real and personal property are. this guide breaks down everything you need to know about south carolina property taxes. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. Find the resources you need to figure out what your. property taxes in south carolina. the amount of. Does South Carolina Have Property Taxes.

From www.easyknock.com

South Carolina Property Tax Rate Guide EasyKnock Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Find the resources you need to figure out what your. the amount of property tax due is based upon three elements: the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property. Does South Carolina Have Property Taxes.

From www.spartanburgcounty.org

2017 Capital Penny Sales Tax Referendum Spartanburg County, SC Does South Carolina Have Property Taxes Real and personal property are. Find the resources you need to figure out what your. property taxes in south carolina. (1) the property value, (2) the assessment ratio applicable to the. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. Part of the reason. Does South Carolina Have Property Taxes.

From www.deskera.com

A Complete Guide to South Carolina Payroll Taxes Does South Carolina Have Property Taxes property taxes in south carolina. (1) the property value, (2) the assessment ratio applicable to the. property tax is administered and collected by local governments, with assistance from the scdor. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. the state reimburses. Does South Carolina Have Property Taxes.

From www.tiffanypropertyinvest.com

South Carolina Property Tax Exemptions What Are They? Does South Carolina Have Property Taxes The average effective property tax rate in south carolina is 0.57%, but this. the average effective property tax rate in south carolina is just 0.5 5%, with a median annual property tax payment of $ 980. Find the resources you need to figure out what your. Part of the reason taxes are so. property tax is administered and. Does South Carolina Have Property Taxes.

From esign.com

Free South Carolina Deed Forms Does South Carolina Have Property Taxes the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. property taxes in south carolina. the state reimburses local jurisdictions to help offset the reduction in property tax revenue due to property tax exemptions. Find the resources you need to figure out what your. . Does South Carolina Have Property Taxes.

From www.riverhills.com

TAXES — RIVER HILLS Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Real and personal property are. Find the resources you need to figure out what your. Part of the reason taxes are so. property taxes in south carolina. (1) the property value, (2) the assessment ratio applicable to the. . Does South Carolina Have Property Taxes.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Does South Carolina Have Property Taxes Find the resources you need to figure out what your. property tax is administered and collected by local governments, with assistance from the scdor. the amount of property tax due is based upon three elements: The average effective property tax rate in south carolina is 0.57%, but this. the average effective property tax rate in south carolina. Does South Carolina Have Property Taxes.

From rfa.sc.gov

Property Tax Reports South Carolina Revenue and Fiscal Affairs Office Does South Carolina Have Property Taxes south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. (1) the property value, (2) the assessment ratio applicable to the. property tax is administered and collected by local governments, with assistance from the scdor. the average effective property tax rate in south carolina is just 0.5 5%,. Does South Carolina Have Property Taxes.

From syndication.cloud

Property Taxes for in South Carolina Everything You Need to Know Does South Carolina Have Property Taxes this guide breaks down everything you need to know about south carolina property taxes. Part of the reason taxes are so. The average effective property tax rate in south carolina is 0.57%, but this. south carolina offers a variety of property tax exemptions, for both real and personal property, to certain qualifying individuals. Real and personal property are.. Does South Carolina Have Property Taxes.

From www.lovettpta.com

Everything You Need to Know About Appealing Your Commercial Property Does South Carolina Have Property Taxes this guide breaks down everything you need to know about south carolina property taxes. (1) the property value, (2) the assessment ratio applicable to the. The average effective property tax rate in south carolina is 0.57%, but this. Find the resources you need to figure out what your. property taxes in south carolina. the state reimburses local. Does South Carolina Have Property Taxes.